It’s not news that consumer spending is off, but in municipal bond country this also means sales taxes are coming in lower. Some communities, such as those that depend on major shopping malls may see a double whammy from their major taxpayer, who will be looking to lower their assessed valuation (or worst case, miss their tax payments and face foreclosure – dead mall anyone?) Take Richmond Heights, Missouri, for example. A tony suburb of St. Louis, blessed by heavily trafficked intersections, Richmond is home to the St. Louis Galleria. Sales taxes made up 43% of the city’s 2008 revenues while 12% came from property taxes. From 2007 to 2008 sales taxes fell from $10.4 million to about $9.5 million. The St. Louis Business Journal reports that sales tax revenue was $6.6 million through March, 2009. The Galleria represents 14% of the property tax base and is the top taxpayer in the city.

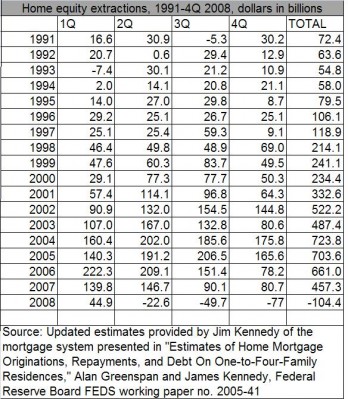

Consumer spending, despite what people are saying, is not likely to return to previous levels. The reason? Much of consumer spending was driven by home equity extractions during the boom years of property value appreciation. The attached chart shows equity extractions through second quarter, 2008. If you look at the chart for a moment, you will see the clear pattern. Between 2002-2007 alone, more than $3.4 trillion was extracted from home values and spent somewhere.

A second reason for reduced spending is retirees who are in the consumption phase of living but have lost a bundle on their retirement assets. Many may also worry that their on-going pension payments could thin out (see post on Prichard, Alabama).

We don’t need to remind the reader that the home equity ATM is out of order. Households are saving (what’s wrong with that?) and it is unclear why some are calling for looser credit so that consumers can borrow more. (Why encourage more borrowing for already bloated balance sheets?) The result is that all of the businesses that grew to support the spending frenzy and all those that were built in anticipation of continued spending will have to go out of business or contract. According to Howard Davidowitz who covers retail, there is 19.5 square feet of stores for every man, woman and child in the United States. We only need 12 square feet, according to his analysis.

General Growth Properties (GGP) which is owner of the Galleria filed Chapter 11 in April 2009. They have more than 200 malls in 44 states. Aside from less shopping revenue to fill their basket, the REIT took on significant leverage when they bought the Rouse Company a few years ago. Among other malls, Rouse owns the South Street Seaport in New York and Faneuil Hall in Boston. Competitors still above water include Simon Properties (SPG), Pennsylvania REIT (PEI) and Vornado Realty Trust (VNO). Despite the bankruptcy many GGP malls continue to operate, although we expect that the REIT is likely to challenge property assessments where possible.

According to the St. Louis Business Journal, the Galleria lost Lord & Taylor three years ago, a key anchor. Nordstrom was supposed to fill that space but has delayed at least a year. Mark Shale, another key anchor tenant closed last spring. Linens n’ Things filed bankruptcy recently and shuttered its store on the opposite side of the intersection (Loans n’ Such?). Nearby, University Village, a mixed-use development is stalled. A Homewood Suites is on target for opening but construction of a Westin was scuttled. Retail development at University Village is on ice as well. Happily, the city has not provided funds for this project.

The city did help fund projects for other commercial projects. Missouri, like California and Florida is one of those states that uses special districts to spur real estate development. District projects can be funded with tax increment, special assessments or sales taxes and the districts are defined so that beneficiaries of capital improvements secure the bonds or certificates. In Missouri, transit development districts are supported by sales taxes and in some cases tax increment taxes from the district receiving the benefit of investment. These securities are not typically rated and are riskier than general obligation bonds. Some cities, like Richmond Heights may be covering debt service payments.

The Francis Place Redevelopment Project RPA1 Tax Increment and Sales Tax Bonds for Series 2005 (also known as The Boulevard — Saint Louis) is one such example. The city approved $39.5 million tax increment financing and issued $19 million in 2005. This was intended to be a mixed use project, a combination of residential, retail, hotel and office. Based on the city’s 2009-2010 budget it looks like the city is covering about half of debt service from general funds.

Manhasset Village’s $3.555 million 2006 bonds are to be paid from special assessments but also have a claim against surplus revenues of the city of Richmond Heights (with no obligation on their part to raise taxes). Manhasset is a 353 unit multi-family project originally built in 1930 and subject to redevelopment into luxury apartments and condominiums. The project is being delayed because of the economy. There is a debt service reserve fund and it does not appear the city is covering debt at this time.

Francis Place Redevelopment Project RPA 2 is still on the drawing board but the city’s budget shows debt issuance for 2010-2011. The city has pledged $19.2 million tax increment to this project. The city has pledged another $38.25 million tax increment financing for Hadley Township Redevelopment, which has also stalled. The city has about $16.8 million certificates outstanding, payable from city general funds but they are expecting to pay from sales taxes. We hope the city keeps its hand on its pocket as it tackles some difficult decisions over the next year.

As City Manager of Richmond Heights, I can say with great confidence that this article is completely inaccurate. Your assumptions above regarding payments and financing are incorrect and you should speak with City Staff to provide accurate information.

Editor’s note: All information in the article is taken from publicly disclosed documents from the city, the audit, budget and management statements by the city themselves. We welcome the city’s clarification of specifically what we got wrong and wait their call back. See link to St. Louis Business Journal on this topic: http://stlouis.bizjournals.com/stlouis/stories/2009/05/25/story1.html